Biologic drug substance developers face an ever-evolving slate of challenges related to CDMO outsourcing. As part of ISR’s CDMO Benchmarking research, respondents are asked to review a list of 28 selection attributes and to identify the one criterion most important to them when choosing a provider for biologic drug substance manufacturing services. This year, survey participants primarily came from large (R&D $1B+) or midsize (R&D $100M – $999M) biopharma companies across North America and Western Europe.

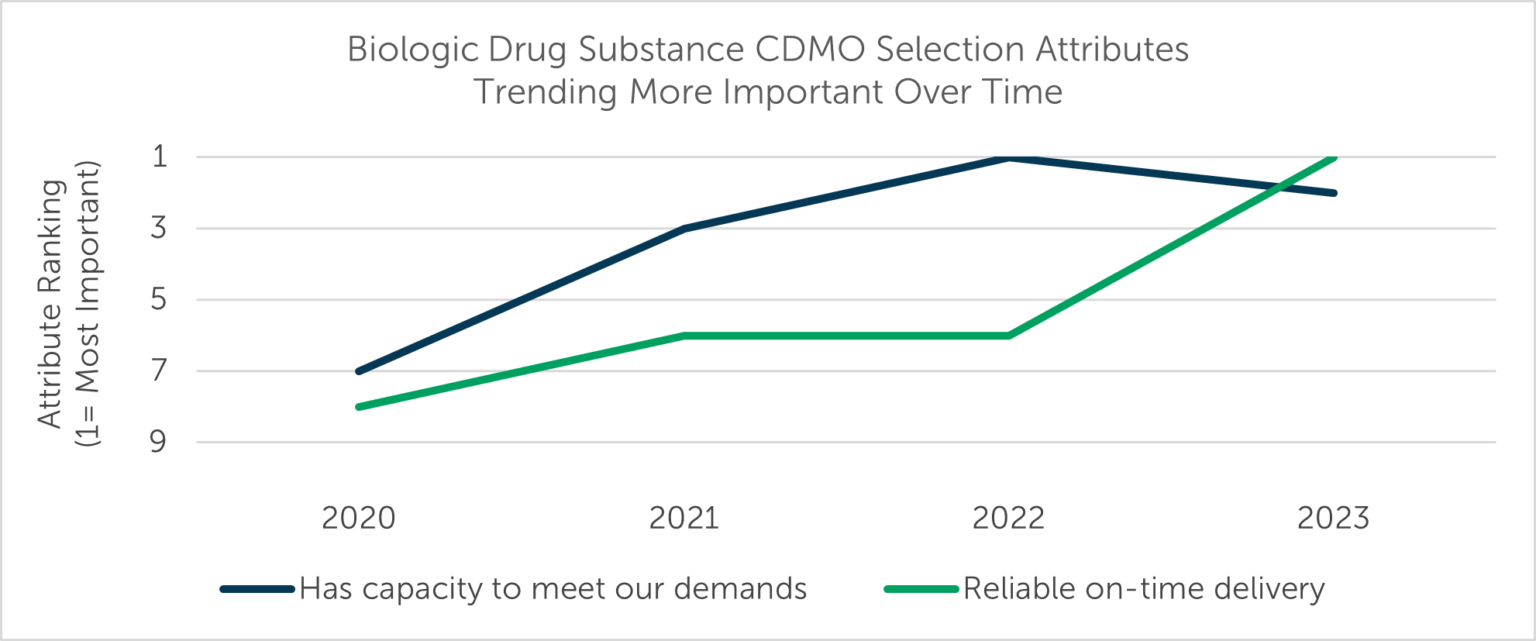

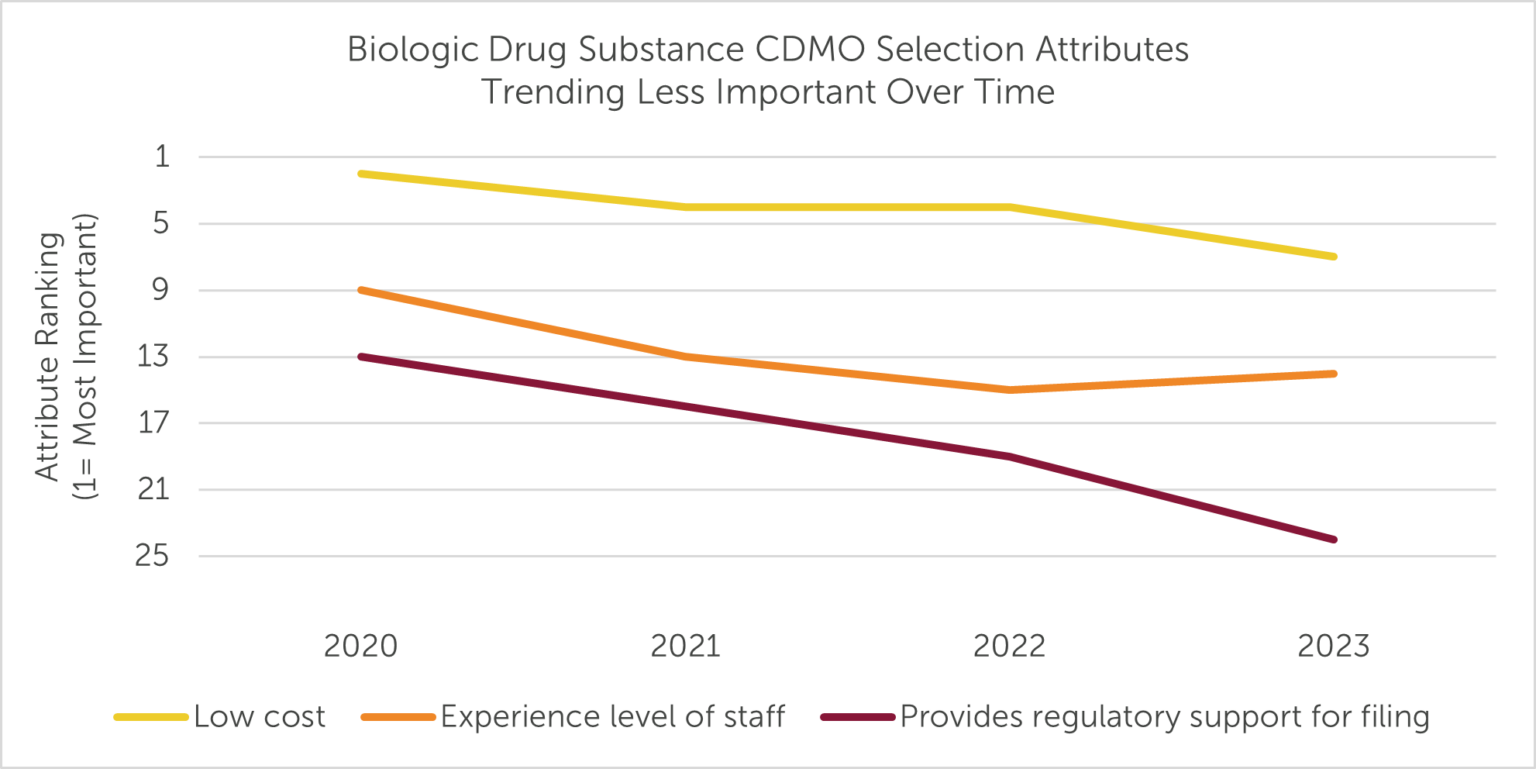

Year-over-year variation always exists in the selection criteria respondents prioritize in an outsourced manufacturer. However, five metrics have exhibited the most noteworthy trends since the start of the decade (2020-2023): of these, Low cost, Experience level of staff, and Provides regulatory support for filing have become less important to outsourcers over the past three years, while Has capacity to meet our demands and Reliable on-time delivery have risen in priority.

Trending Up

Outsourcers are increasingly concerned about their service provider’s ability to deliver on time, in full (OTIF). Reliable on-time delivery and Has capacity to meet our demands rose from the eighth and seventh “Most Important” attributes sought by study respondents in 2020 to first and second, respectively, in 2023 (Fig. 1).

Figure 1

Faced with numerous lingering pandemic-related challenges, outsourcers are keen to work with CDMOs that deliver the contracted amount of biologic drug substance in a timely manner. Each year, ISR surveys drug innovators who have outsourced biologic drug substance manufacturing within the last 18 months. Respondents then rate their CDMO’s performance on 22 attributes across five main categories: Delivery Factors, Organization Factors, Capabilities, Staff Characteristics, and Service Capabilities. The latest findings, as well as detailed Company Service Quality Profiles for providers with 10 or more ratings, are included in the Biologic API CDMO Benchmarking (8th Edition) report.

Trending Down

Despite being ranked the second “Most Important” selection attribute in 2020, Low cost has fallen to seventh place over the last three years (Fig. 2). On average, outsourcers may be willing to pay more to ensure their biologic drug substance is manufactured on time, selecting providers based on the value of their services, rather than awarding contracts based on low cost alone.

Figure 2

Additionally, Provides regulatory support for filing, which often falls outside the 10 “Most Important” provider attributes named by study respondents, appears to be slipping even further as a CDMO selection consideration relevant to biologic drug substance manufacturing: the criterion dropped from 13th in 2020 to 24th in 2023. This may be due to sponsors outsourcing this service ad-hoc to specialized consultants or through a functional service provider (FSP) model, rather than requiring their primary manufacturing provider to perform the function. Furthermore, declining need for regulatory support may be indicative of investment by larger biopharma companies to grow their internal expertise.

Experience level of staff has also declined in importance as a CDMO selection criterion in recent years (Fig. 2). Though consistently ranked among the top 10 “Most Important” selection attributes pre-pandemic, staff experience ranked 15th and 14th, respectively, in the 2022 and 2023 surveys. Drug developers appear to care more about the ability to complete the job and less about the role-specific experience of the CDMO’s personnel — perhaps an acknowledgment that turnover and staffing challenges are an issue for many service providers (i.e., role-specific experience may not currently be a reliable differentiator).

Furthermore, expertise among staff is conceivably less critical now than it was in the early days of biologics development. CDMOs have continued to improve and standardize their organization-wide processes for biologic drug substance manufacturing over the past decade, providing a more structured framework for less-experienced staff to leverage to successfully execute job functions.

Conclusions

As biologics continue to comprise a growing share of FDA approvals, CDMOs would be wise to understand and address patent holders’ frustrations with drug substance manufacturing activities. Outsourcers responsible for provider selection seek partners who can reliably deliver OTIF and appear to be deprioritizing staff experience and one-off services (e.g., regulatory support) in the evaluation process. It remains to be seen how record inflation may impact drug developers’ opinions on the importance and impact of biologic drug substance manufacturing service costs going forward.

The trends identified here are based on four years of data from CDMO Benchmarking surveys and are not intended to project future results. The data are based on average aggregate findings and may not reflect nuanced variation based on company size, respondent location, or phase of biologic drug substance manufacturing.

Primary market research data in this article were powered by the ISR Health Panel. Want to contribute to thought leadership pieces and help to make the pharma industry better? Join today.