The Growing Cell & Gene Market

The outsourced cell and gene manufacturing space has experienced notable expansion and change in recent years. As the advancement of cell and gene therapies continues, drug innovator companies have come to rely heavily on service providers to meet their manufacturing needs. Outsourcing allows innovators to leverage the specialized expertise and capabilities of contract development and manufacturing organizations (CDMOs), to reduce costs and to accelerate time to market.

Given the level of activity, Industry Standard Research (ISR) wanted to better understand current and future market dynamics for these types of therapies. ISR surveyed 100 biopharmaceutical professionals who have decision-making responsibilities in outsourced cell and/or gene therapy (CGT) manufacturing. These individuals have experience working with CDMOs of varying size and specialty, from large, global providers to mid-size and niche companies. Our respondents shared their unique perspectives and insights to assist the broader industry in making the best decisions possible with regard to their cell and gene assets.

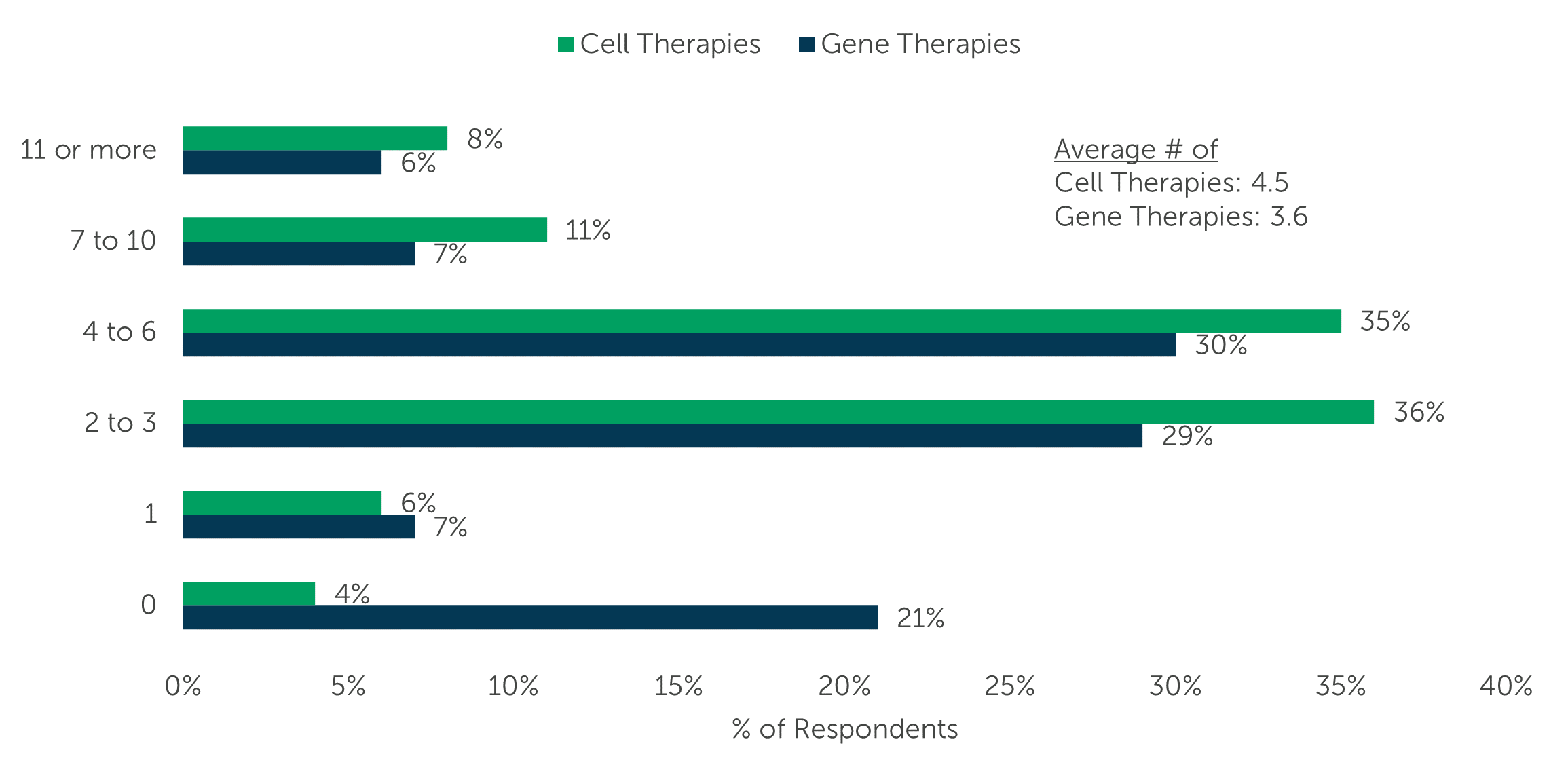

Number of Cell & Gene Therapies in Pipeline

The research shows that drug developers have an average of 4.5 cell therapies and 3.6 gene therapies in their pipelines. The volume of cell and/or gene therapies in the pipeline were similar for the majority of respondents; around one-third stated they have 2 to 3 of either therapy type in development (36% cell and 29% gene), while another third revealed they have 4 to 6 (35% cell and 30% gene).

“Approximately how many cell therapies are in your company’s pipeline?” (n=100)

“Approximately how many gene therapies are in your company’s pipeline?” (n=100)

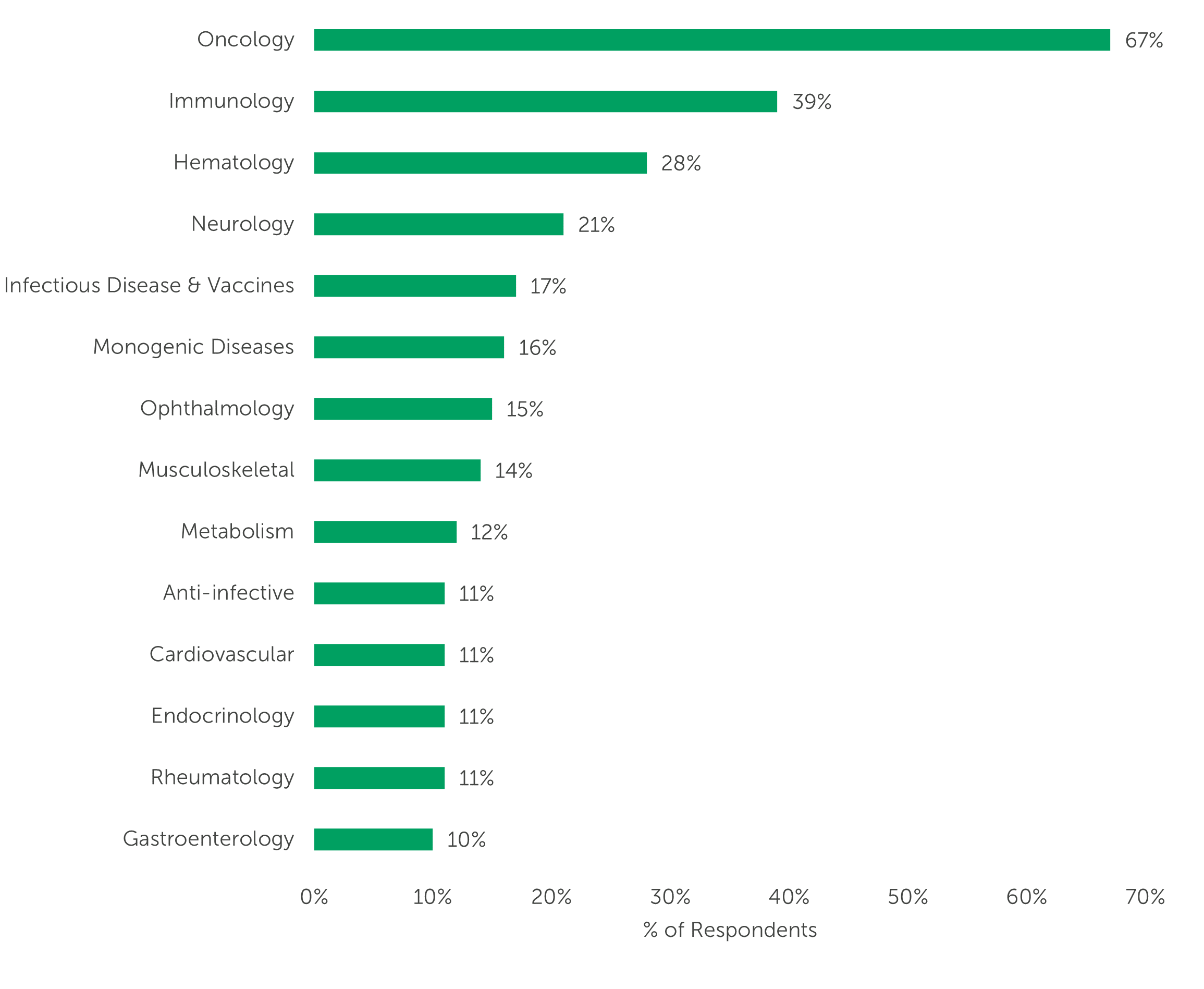

Therapeutic Areas of Focus

Cell and gene therapies can offer innovative treatments to address unmet medical needs, such as harnessing the body’s own immune system to specifically target cancer cells or enabling more personalized medicine through gene editing. Given the potential these therapies have for realizing the shared dream of curing cancer, it’s unsurprising that two-thirds of our survey respondents (67%) relayed that the cell and/or gene therapies in their company’s pipeline target Oncology. Other therapeutic areas of focus include Immunology (39%), Hematology (28%), and Neurology (21%).

“Which therapeutic areas are the cell and/or gene therapies in your company’s pipeline designed to target?” (n=100)

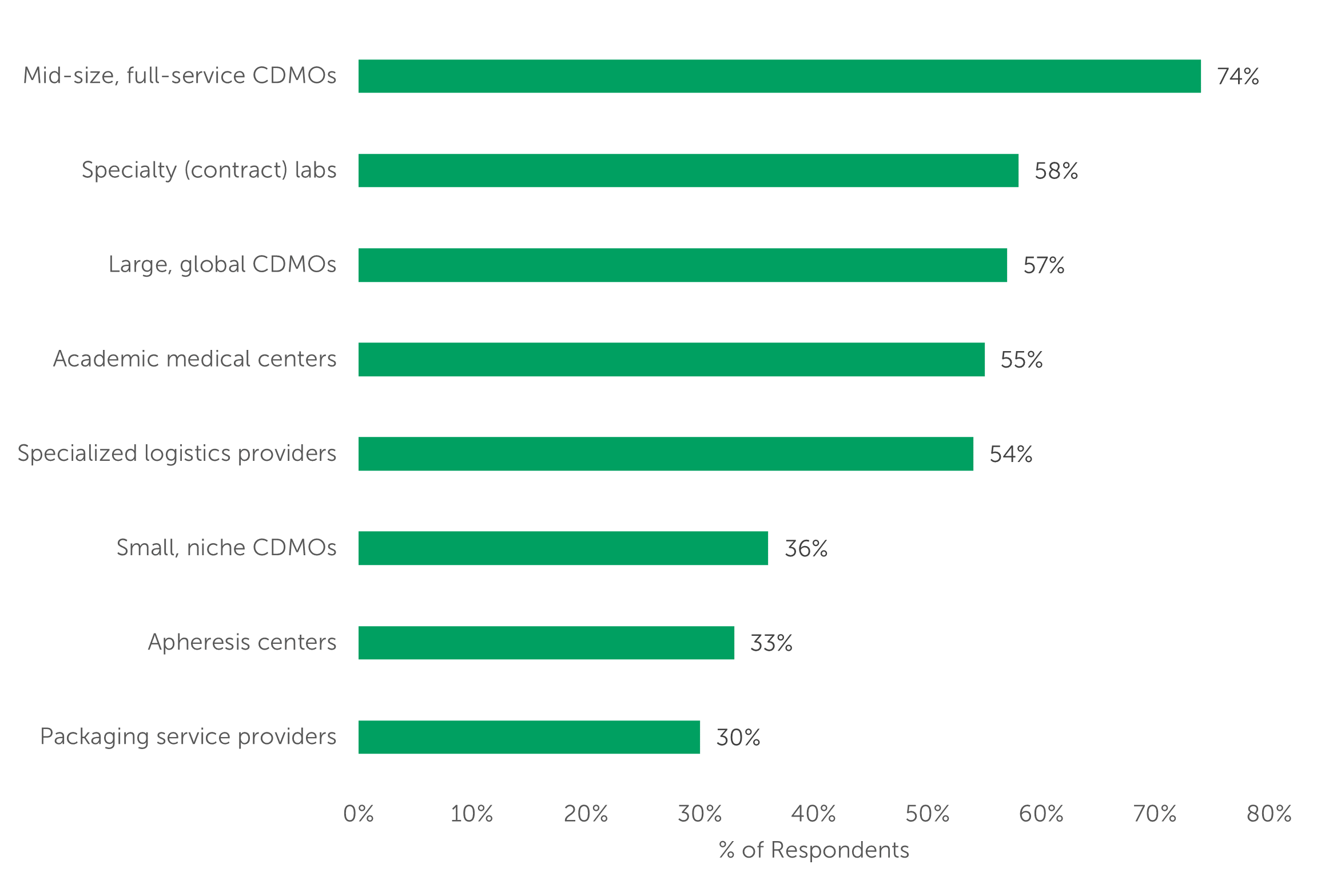

Types of Service Providers Used

Innovators seek to partner with providers that understand their unique needs at each stage of drug development. We asked respondents to select each of the provider types their company is using to support their cell/and or gene therapy needs. Mid-size, full service CDMOs topped the list with three-quarters (74%) of respondents indicating use of this provider type. Specialty (contract) labs (58%), Large, global CDMOs (57%), Academic medical centers (55%), and Specialized logistics providers (54%) are also used by the majority of outsourcers. Small, niche CDMOs are used by just over one-third of respondents, showing that larger CDMOs with a full suite of services are relied on by a greater proportion of respondents.

Respondents also reported they currently use an average of 2.8 CDMOs, and that is expected to increase to 3.6 over the next 5 years. This anticipated trend, alongside positive forecasts for CGT sales growth, predicts that the cell and gene manufacturing market is primed for continued expansion and innovation in the years to come.

“Select each type of service provider your company is using to support your cell and/or gene therapy manufacturing and distribution needs.” (n=100)

Navigating Challenges in Cell & Gene Outsourcing

Within the cell and/or gene therapy space, companies seem to face similar challenges regardless of size, scale, or budget. The findings in our survey indicate that a key factor in mitigating these challenges is identifying the right provider for their manufacturing and distribution needs. While it’s difficult to forge trusted outsourcing partnerships, meaningful progress is made when companies have in-depth conversations about how to meet each other’s expectations. Our Cell & Gene Therapies Manufacturing Market Outlook adds to the conversation by offering novel insight for sponsors and service providers alike to help them successfully navigate this rapidly changing industry.

Primary market research data in this article were powered by the ISR Health Panel. Want to contribute to thought leadership pieces and help to make the pharma industry better? Join today.