Clinical Trial Logistics Market Dynamics

Clinical trials often span numerous sites around the globe and continue to implement more and more decentralized elements, such as in-home visits by healthcare providers. Accordingly, the storage and distribution of clinical trial material has become increasingly complex.

For example, while efforts are underway to better harmonize different nations’ regulatory requirements, many disparities still exist. Additionally, global unrest — be it the COVID-19 pandemic or the war in Ukraine — has led to changes in import/export policy and oversight, as well as supply chain challenges. And, from an industry standpoint, improved means of production have led to huge volumes of biologics, plus cell and gene therapies (CGT), that require special handling and temperature controls to remain therapeutically viable and safe for use (for testing and transport between biopharma facilities as well as trial distribution).

Provider Preference

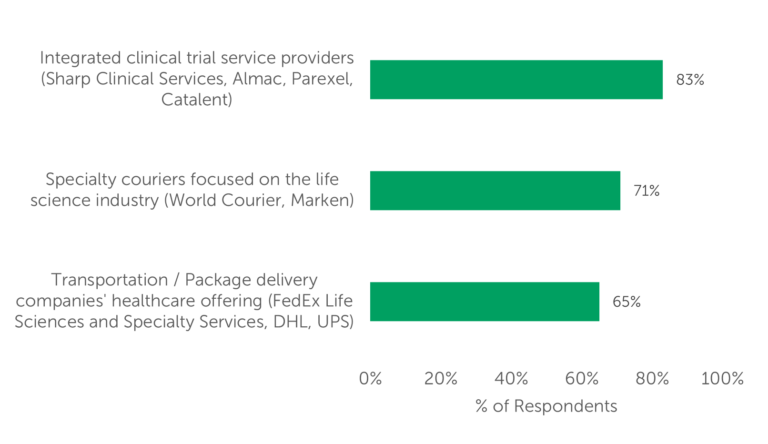

A recent study conducted by Industry Standard Research (ISR) surveyed 100 qualified decision-makers who outsource clinical trial logistics to gather their insights on industry trends and market dynamics, in addition to the selection criteria they apply when choosing a clinical logistics service provider. ISR’s research revealed that most outsourcers seek to remedy, or to mitigate the impact of, complex challenges presented by clinical trial logistics by utilizing one (or some combination) of three solutions (Fig. 1):

- integrated clinical trial providers (e.g., Almac or Catalent)

- specialty couriers that focus on the life sciences industry (e.g., World Courier or Marken)

- the healthcare offerings of the large transportation/package delivery companies (like FedEx, UPS, or DHL) for clinical logistics.

Fig. 1 — Categories of providers currently used by respondents for clinical logistics

Clinical Logistics Volume by Provider Category

The high-percentage use of integrated clinical trial service providers may be attributable to the fact that the survey-takers have engaged these companies for other services already, making it convenient to simply tack on additional services to their existing partnership with that provider. Still — likely due to the increased demand for more situational material handling and transport — both specialty couriers and transportation/package delivery companies are frequently used, as well.

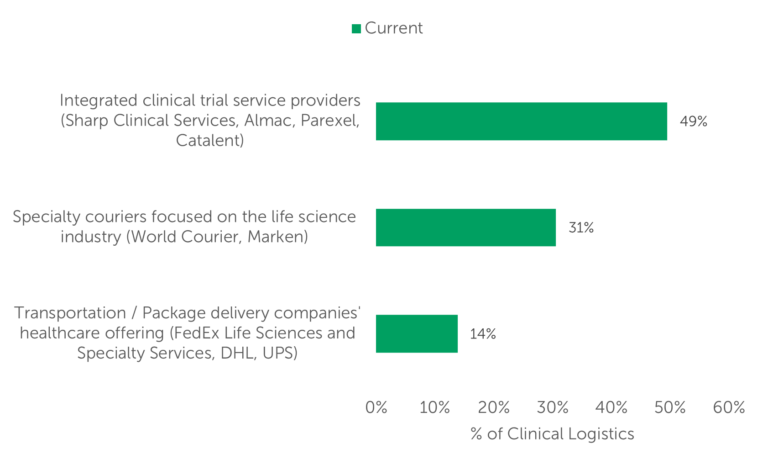

The study also showed that, according to respondents, integrated clinical trial service providers conduct the largest volume of clinical logistics (49%). Specialty couriers conducted nearly one-third of clinical trial logistics, and transportation/package delivery companies account for 14% of clinical logistics volume (Fig. 2).

Fig. 2 — Volume of clinical logistics currently conducted by provider category

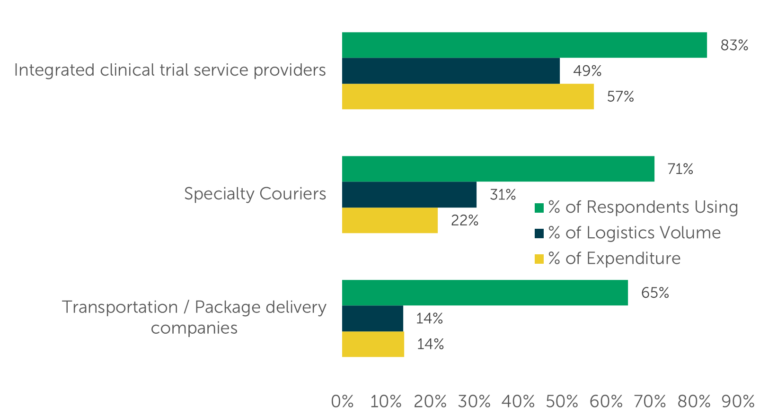

Provider Use, Logistics Volume, and Expenditure

Given that both specialty couriers and transportation/package delivery companies are frequently used for clinical logistics, they account for less volume than might initially be predicted — possibly because respondents already are engaged with an integrated provider, making it simpler for that provider to win the business. Moreover, specialty couriers and transportation/package delivery companies typically are used for “simpler” work: more “get this from point A to point B” than “deliver this at minus 90 degrees, with temperature sensors, to a remote region within 36 hours.” However, as the need for specialty couriers is increasing commensurate with growing biologics and CGT special handling needs, it can be speculated that traditional transport companies will seek to expand their service offerings to take advantage of demand for this type of business.

ISR also questioned respondents about their expenditure on each type of provider, revealing that expenditures roughly aligned with the volume of clinical logistics each provider type conducted. For example, integrated clinical trial service providers account for 49% of clinical logistics conducted and 57% of expenditure on clinical logistics (Fig. 3).

Fig. 3 — Current Provider Use, Logistics Volume, and Expenditure

Final Thoughts

To address their outsourced clinical trial logistics needs, sponsors contract out the majority of these activities to integrated clinical trial service providers, specialty couriers, and transportation/package companies. Interestingly, this finding largely aligns with past ISR research. Nevertheless, logistical changes in this area generally take place over several years, rather than weeks or months. Thus, biopharma organizations will want to keep a close eye on this space as clinical logistics providers adapt to the lasting impacts and challenges created by the pandemic and sociopolitical strife around the globe.