Requests for proposals have been well-established and can help sponsors evaluate service providers. RFPs aren’t without effort, time, and evaluation to determine which provider is best. RFPs are a useful tool to decide which sponsor to pursue bids from and yet they require a heavy investment of resources. This is a two-way street, with each side vying for the best business contract. Let’s dive into what affects small and emerging sponsors’ final decision to engage a service provider.

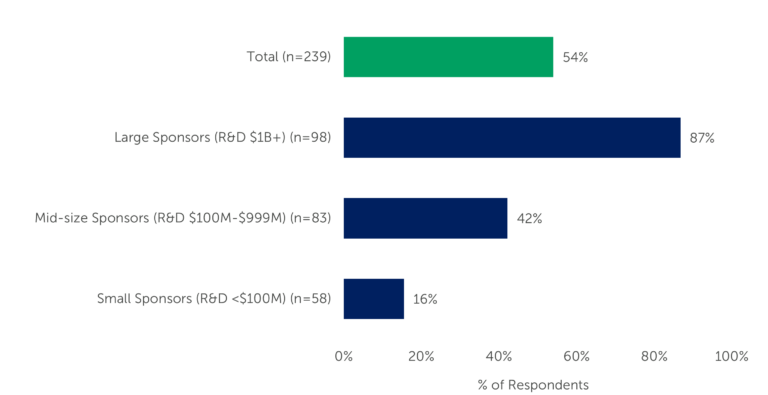

Preferred provider agreements (PPAs) are one way in which service providers position themselves well to gain sponsors’ business. Looking at Q4 2022 data from biopharma professionals who recently outsourced some aspect of a Phase II/III clinical trial, we see a wide range between those whose companies have PPAs and those who do not. Overall, among the 239 biopharma professionals, 54% indicated their companies had PPAs. However, there is quite a difference when viewed by the company’s R&D annual spend.

PPAs by Company Size

Company size is a defining role in whether sponsors use preferred provider agreements. PPAs are used by 87% of those at large sponsor companies (R&D spend of $1B or more) and 42% of those at midsize sponsor companies (R&D between $100M and $999M). Just 16% of those at small sponsor companies (R&D spend less than $100M annually) use PPAs.

Figure 1 – “Does your company have formal preferred provider agreements for Phase II/III services?” (n=239)

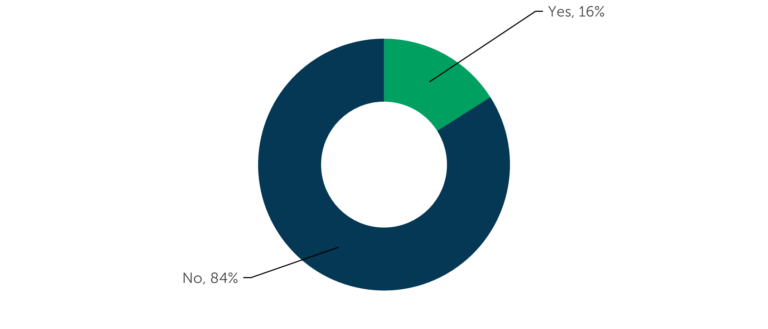

When it comes to outsourcing Phase II/III clinical development work, PPAs are used by just 16% of respondents at small and emerging companies. This suggests that service providers may be able to bid their services to these smaller sponsors without the hurdle of other agreements in place.

Figure 2 – “Does your company have formal preferred provider agreements for Phase II/III services?” (n=58, those respondents in the Phase II/III CRO Benchmarking (15th edition) at non-large companies (R&D <$100M))

ISR dedicated an entire report to small and emerging pharma in light of this difference. Our report gives insight into what matters to those at small and emerging sponsor companies, the providers they prefer to work with, and the selection drivers important to those at small and emerging biopharma companies.

Small and Emerging Biopharma Selection Attributes

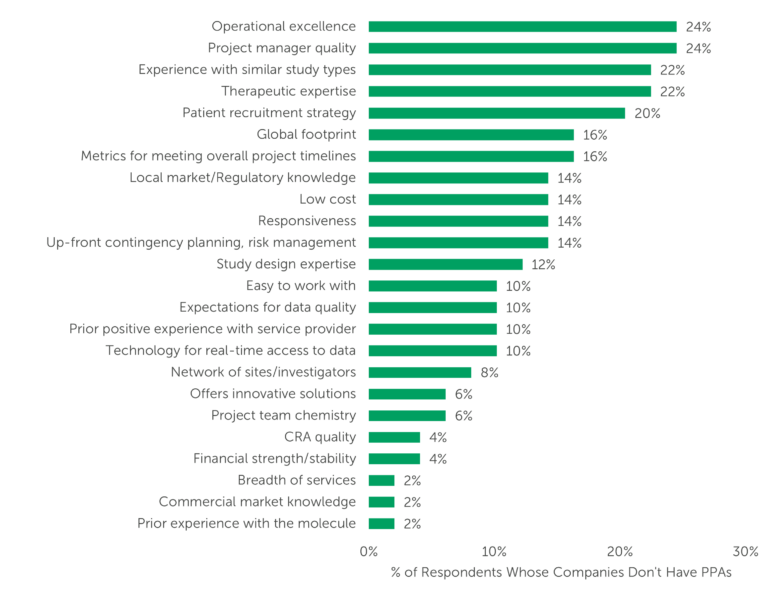

When looking for a provider for Phase II/III clinical trial activities, what are sponsors looking for? What do they prioritize and what could cause a lost bid? Respondents report the attributes that matter most to them, selecting their “Top 5” and the “Most important.” We also ask them which attribute is gaining importance in selecting a CRO for outsourcing services.

The attributes gaining importance among those at small and emerging companies are Project manager quality and Operational excellence, each with 24% of respondents indicating that importance in these areas is rising (see Figure 3). Operational excellence has been cited among the top attributes gaining in importance for all four years of ISR’s Small Pharma Outlook analysis. Furthermore, this same attribute, Operational excellence, was selected by respondents at large, midsize, and small and emerging sponsor companies – with or without PPAs – as an important selection criterion.

Here, we see Experience with similar study types tied with Therapeutic expertise, each with 22%, as attributes gaining importance for those at small and emerging companies without PPAs.

Figure 3 – “Which of the following attributes has/have become more important as selection criteria for Phase II/III studies over the past 12 months? Select up to 3.” (n=49, only asked of respondents whose companies do not have preferred providers)

The findings in our report can help CROs optimize operational and marketing strategies to better accommodate small and emerging biopharma companies. However, a company can’t successfully promote its services without understanding its brand awareness and position in the market. Understanding how satisfied your customers are can inform your business objectives to win more contracts. Check out our reports and/or consider doing a custom brand study with us to gain deeper insight into your brand and market position.