Highly potent API manufacturing is a rapidly growing segment of drug development. Those familiar with HPAPI understand its specialized nature and the strict regulations surrounding it. A complicated and resource-intensive process, sponsors often find themselves in need of knowledgeable outsourcing partners to achieve their manufacturing goals. ISR explores these outsourcing motivations and their impact for the benefit of sponsors and providers alike with the Highly Potent API Market Outlook.

100 respondents from North America, Europe, and Asia completed a 20-minute, web-based quantitative survey in Q1 of 2022. These verified outsourcers were screened prior to participation and were required to work at a pharmaceutical or biotech company, have been involved in small molecule assets requiring high containment/special handling within the past 18 months, and have at least one such asset either in development or on the market.

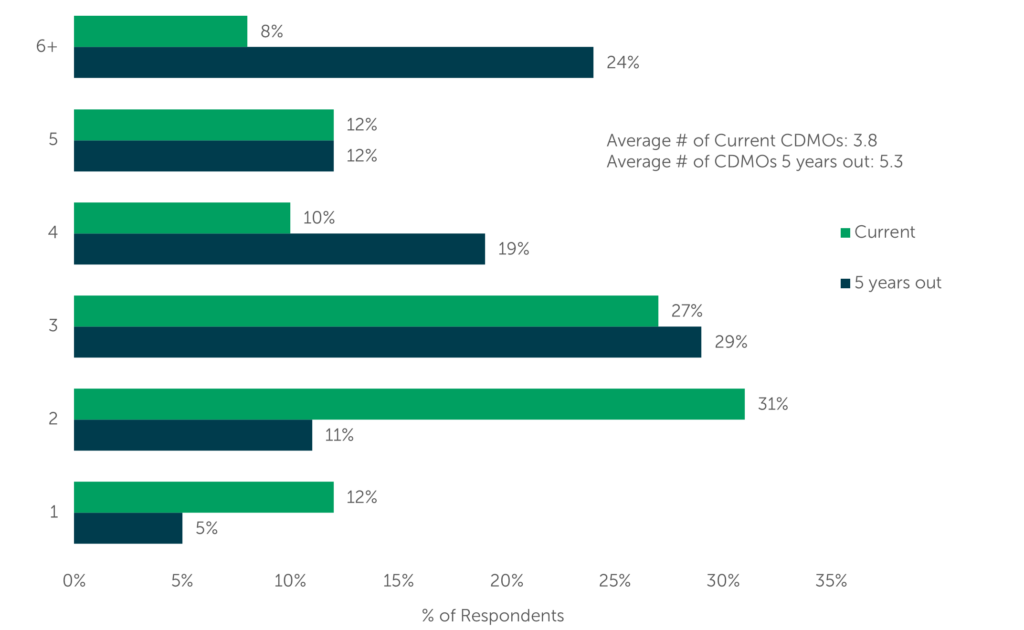

Sponsor companies will learn which highly potent manufacturing activities their peers outsource and which activities they may conduct in-house. Survey respondents predict they will use more CDMOs for HPAPI manufacturing five years from now; currently 8% of respondents use 6 or more CDMOs to meet their highly potent manufacturing needs, but 24% expect to be utilizing at least 6 providers by 2027. Projections like this one offer some guidance to biopharma companies as they consider building their own HPAPI capacity or focus on prioritizing long-term agreements with trusted providers.

CDMO Usage Rates for HPAPI

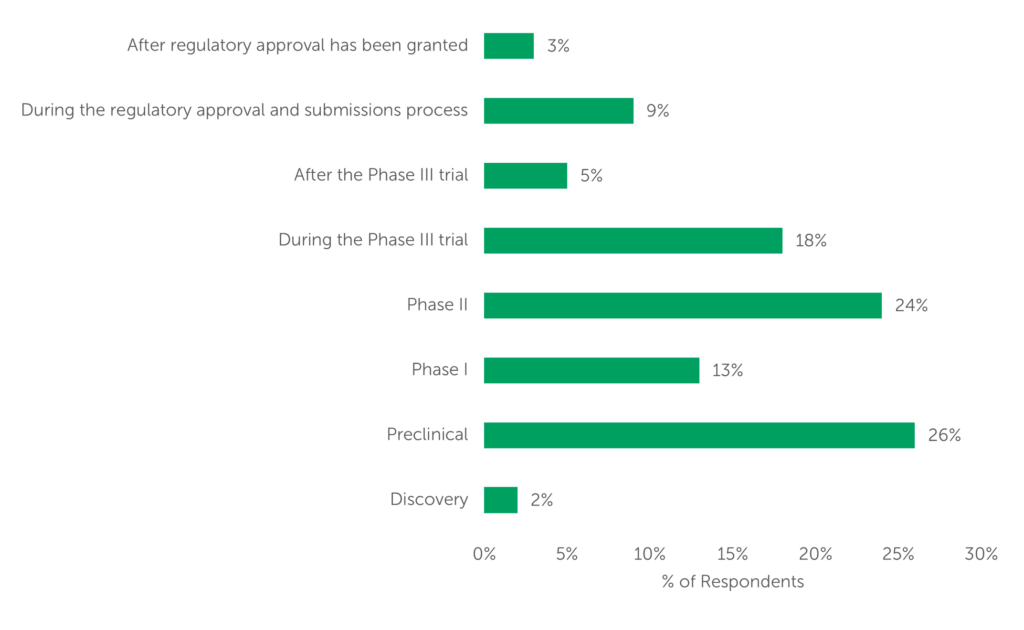

For service providers, understanding what outsourcers expect from HPAPI manufacturers is tantamount to winning bids for those projects. Understanding when to have the conversation, however, could be just as important. One-quarter of respondents begin seeking manufacturing partners at the Preclinical stage, while another quarter begin their search in Phase II. These data also point towards a preference for finding a CDMO that can help a sponsor from development to commercial approval. This echoes other included data pertaining to outsourcing woes: scalability was cited by just over half of respondents as an area of difficulty when outsourcing highly potent manufacturing.

CDMO Selection Timing

Despite any outsourcing blues, respondents also indicated their top 5 CDMO selection attributes and CDMO satisfaction drivers, showing promise to any current or potential partners wanting to win HPAPI bids. As ISR continues to research the relationship between service providers and sponsors, the data consistently highlight the missing links between the two. Readers of the Highly Potent API Market Outlook will learn how ISR’s analyses point to best practices for connecting those links. The implementation of said practices results in fruitful, lasting partnerships in this segment of drug development.

Register an account for access to ISR’s collection of informative free resources such a whitepapers, infographics, and industry statistics.

Feel free to email ISR’s point of contact for syndicated research, Brandon Allison (BrandonA@isrreports.com), with any questions or for additional information.