Services marketers are often not evaluated on actual marketing performance. The lack of objective and relevant performance measures can limit respect for the marketing function and influence within the organization, and that’s problematic. Instead, services marketers are often evaluated on results outside of their control and on non-strategic measures. However, services marketers can take control by implementing credible marketing effectiveness measures and creating their own narrative. This starts with proactively defining the measures of services marketing effectiveness in the organization, choosing a measurement framework, and reporting on successes and failures.

Why Current Measures Are Inadequate

When services marketers do not own their measures, the definition of marketing effectiveness is created for them. The definition is often subjective, incomplete, or omits one or many factors of marketing performance. Some common examples of the limited bases used to measure marketing effectiveness today include:

Overall Organizational Performance

In this scenario, when the organization is performing well, marketing is assumed to be effective. That may seem great for a marketer when the company is doing well. But it’s not great for the marketer or the organization because drivers of success — or failure — of the services marketing plan are not well understood.

Internal Stakeholder Needs

Sometimes the marketing function is evaluated on how well internal stakeholder needs are met. For example, how well did marketing meet the needs of sales when preparing for a bid, defending a proposal, or developing marketing collateral or leads? However, prioritizing the needs of internal stakeholders is often a by-product of interactions with your colleagues and doesn’t provide much value internally or to customers.

While managing internal relationships is certainly important, success in this capacity does not earn strategic influence within your organization and does not inherently meet the needs of your customers. When an organization is doing well, there is nothing to question and nothing to fix. However, when the organization has trouble — a downturn in RFPs and/or sales — the marketing department can quickly become a target if its performance metrics aren’t in order.

Tactical Execution

Tactical measures can be objective, but they may not be meaningful. Tactical measures used by some organizations include the number of trade shows managed, the number of articles published, the number of emails sent, and the open rates of email communications. While such metrics are useful and informative, they are only meaningful when used to accomplish services marketing objectives, such as raising awareness, educating customers, and influencing perceptions of your company’s products, services, and employees.

The end goal is not to manage 25 trade shows or 200 email campaigns. Instead, the goal is to increase your presence and footprint in the industry in a meaningful way. Did you educate your prospects? Did you build upon established relationships and begin to build new ones? Were RFPs generated? Furthermore, reporting tactical results outside the context of marketing goals may be risky. It can lead to a perception of wasted costs and questioning of marketing spending.

Non-Marketing Measures

Connecting sales results to marketing effectiveness is a common example of holding marketing accountable for measures it does not directly impact. Yes, marketing does influence RFP volume by raising awareness and influencing preferences, but marketing cannot win the proposal; a marketer only has indirect long-term influence over sales. This is a common misunderstanding, and it highlights the need for marketing to create its own narrative about marketing effectiveness.

What does Marketing Influence?

Creating your own performance narrative begins with understanding what you, as a services marketer, can directly influence. Marketing can influence awareness, perceptions, and knowledge, all of which directly impact preference and intentions. Let’s briefly define each of these:

Awareness

Describes the extent to which target customers recognize your brand and products. In the universe of your prospective customers, how many recognize your brand? One key phrase here is “target customers.” A small service provider should probably not measure its awareness among Top-10 pharma companies, as they are not likely to be realistic customers.

Familiarity

Describes the belief a prospective customer holds about a brand and can be thought of as education. There are often right and wrong answers to questions of familiarity, and marketers are responsible for enabling prospects to answer correctly.

- Does a prospect believe a brand offers the required services?

- Does a prospect believe a brand has the experience required to deliver the service to a high-quality standard?

- Does the prospect believe the brand is interested in performing work for his or her company?

Perceptions

Describes potential customers’ feelings about a brand, products, services, and employees. Perceptions are not necessarily true or false and can be thought of as opinions. Marketing can influence the emotional connections you make with customers, leading them to want to work with your company. Examples of perceptions include:

- I like this company.

- I want to work with this company.

- This company is a responsible member of the life sciences community.

- I trust this company will do good work.

What to Measure to Improve Your Strategic Value

The head of marketing can address the lack of objective and relevant performance measures by establishing a framework for the evaluation and communication of marketing effectiveness. This framework should include a measurement process and scorecard of performance for the marketing function. One measurement construct is described below. This is just one way to measure services marketing effectiveness; other credible and effective models exist. The key is to pick a framework for measurement and proactively implement it.

A Highly Diagnostic Model

The model below is a highly diagnostic tool representing the strength of a brand through the simplified stages of a purchase funnel. The findings are clear and actionable for marketers. These measures can help you behave strategically, gain respect in your market, and influence the marketplace. But, how does it work?

The Levels of the Model

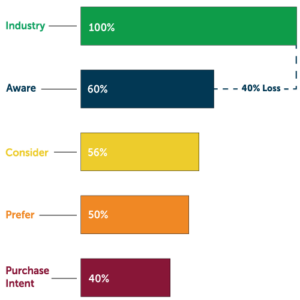

Industry — The top level (green) represents the number of people in a buying universe or all potential buyers in a market.

Aware — The second level (blue) represents the subset of the buying universe who are aware of your organization. There are two fundamental ways to measure awareness: open-ended or close-ended questions. With an open-ended question, the respondent is asked to list the providers they are aware of in a given service category. The close-ended question asks the survey respondent to select providers they are aware of from a list. ISR prefers open-ended questions at this stage.

Consider — The next subset (yellow) is willing to consider your organization in the purchase decision. These respondents are asked which organizations they will consider purchasing from the next time they have a need to purchase in the service category.

Prefer — The second subset from the bottom (orange) prefers purchasing from you. Measuring preference is complex because of the real-world dynamics of B2B purchasing. B2B purchases are often influenced by preferred provider agreements and other constructs that limit purchases of some services to defined organizations.

To gain insight into the impact of the limitations, prospective buyers are asked two questions: 1) who they would prefer to use if the decision were completely up to them, disregarding any organizational rules and regulations, and 2) who they would prefer to use considering what they know about their organization’s purchasing environment, rules, regulations, preferred provider agreements, and any other limitations.

Purchase Intent — Finally, the last subset (red) represents intent to purchase from your company. Respondents are asked who they expect to purchase from the next time they have a need to purchase this service given what they know about the purchase environment.

What Makes A Model Actionable?

Many similar models already exist, and others can be developed, to fit the outcomes you are trying to achieve. This model simply uses awareness, consideration, preference, and intention as its metrics. In creating your own model to fit your unique needs, the expectation is for the model to collect data important to your outcomes at regular intervals — daily, monthly, quarterly, twice per year, yearly — and report it back to key decision makers within the organization. Generally, this is the operations department and members of the C-suite. The model and data within it should provide a solid foundation of evidence for internal stakeholders to determine the effectiveness of what was measured in the time frame and for strategies to be evaluated and adjusted using data, not intuition or estimates.

It is also essential to present both positive and negative findings, as internal stakeholders will be able to determine what is and what isn’t working. Reporting all findings can point to a plausible explanation of what works and what doesn’t and furthers the credibility of the data and its collector. Further, marketing efforts have the potential to impact each phase of the buying process. By understanding where your brand is strong or weak in the buying process, you can adjust and refocus your marketing efforts and strategy.

Keep in mind, awareness, consideration, and preference do not change overnight. Marketing resources are effective when they’re concentrated over time. Measuring the impact of marketing efforts allows you to focus attention in areas where you need sustained effort to achieve an outcome. This gives marketers a tangible way to understand where their efforts are effective, where they are not effective, and where efforts must be targeted. Not only can this model help you measure your brand’s strengths and weaknesses at one point in time, it can also be used to compare results over points in time (e.g., annually). If, for example, you are focused on impacting consideration based on your findings, you can remeasure in a year from now to see if your plans were effective.

By creating your own narrative of what marketing successes and failures are and proactively measuring and reporting, you will earn respect and influence within your organization, and you will have the vital information you need to develop a services marketing strategy that moves your business in the right direction.

Register an account to view our syndicated reports

Learn more about our custom research capabilities

About The Author

Kevin Olson has spent 20 years in and around the pharmaceutical industry, much of it in marketing and market research. In 2008, he founded Industry Standard Research (ISR Reports), a company focused on providing high quality custom and syndicated market research products and services to the drug development and manufacturing community. ISR Reports’ areas of specialization include service quality assessment, buyer-driver analysis, market opportunity analysis, and new product/service development.

About ISR

ISR Reports is a full-service pharmaceutical market research firm that delivers relevant and trustworthy insight into the complex and dynamic pharmaceutical environment through syndicated industry reports, and custom research and consulting services.