Support for Marketing at Pharma Service Providers

Market research helps service providers to not only create relevant, focused content, but also make sure great content reaches their audiences in the ways they are most likely to engage.

This is particularly crucial for companies that operate in niche industries such as pharmaceutical service providers. ISR conducts research to help these providers’ sales and marketing departments get more familiar with where their customers go to learn about new service providers.

ISR surveys respondents from biopharma sponsor companies, all with appropriate decision-making responsibilities for outsourced service provider selection. This is important context for understanding our work – when this article mentions “CDMO respondents” or “clinical development respondents,” we are referring to respondents from biopharma sponsors that outsource work to relevant service providers.

These efforts yield two of our syndicated reports:

These reports are valuable resources for understanding the true voice of customer. Clinical development and manufacturing services providers can use these data to hone their marketing efforts.

Our survey data from clinical and manufacturing respondents revealed some similarities in how they learn about service providers.

Driving Live Webinar Attendance

Webinars are excellent tools for raising brand awareness and educating interested customers. However, these events compete with prospective attendees’ already-busy schedules, so providers must deliver value that justifies putting other work on hold (or if we’re being honest, having the webinar on a second screen while continuing to work).

Our survey takers indicated they would be more likely to attend a live webinar if they got access to special/gated/extra content not available to people who don’t attend the live event (56% of respondents with CDMO responsibilities and 49% with clinical development responsibilities).

Value of Service Provider Generated Info

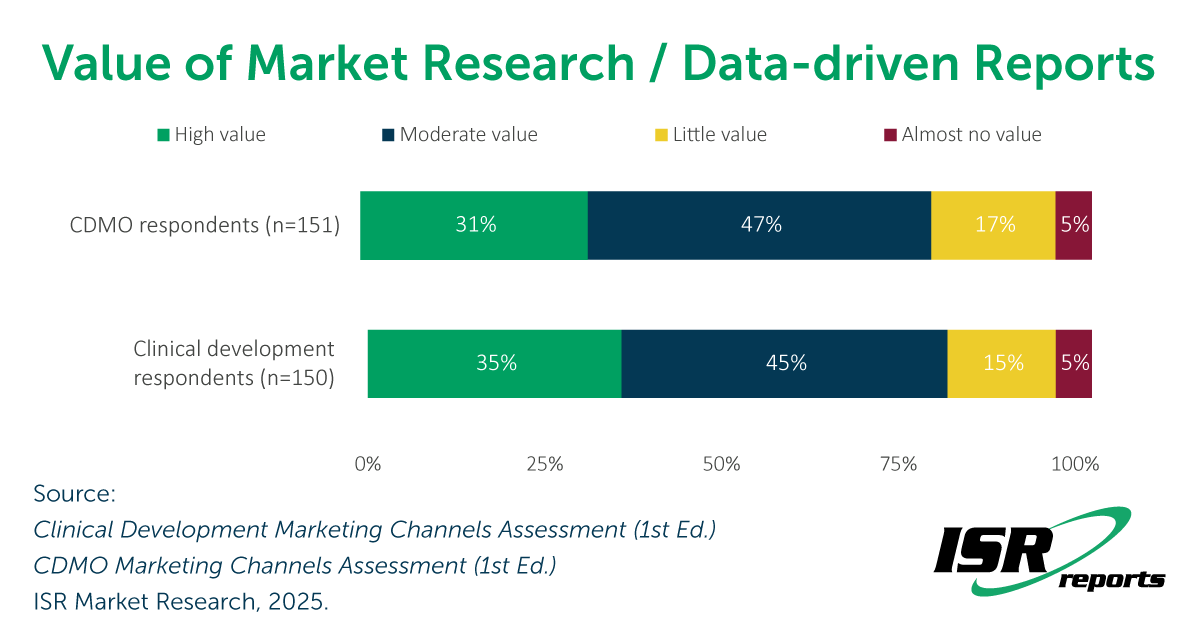

Marketers have many tools at their disposal to produce quality content for specific audiences, but may not always be sure if those audiences find the content valuable.

Providers that research their customers’ perspective and translate their findings into impactful content can be more confident about the value they’re delivering. Our Marketing Channels research supports this: Market research / data-driven reports are rated as the most valuable source of information from service providers (31% of CDMO respondents & 35% of clinical development respondents rated as having “high value”).

Anticipated Use of Industry Information by Source

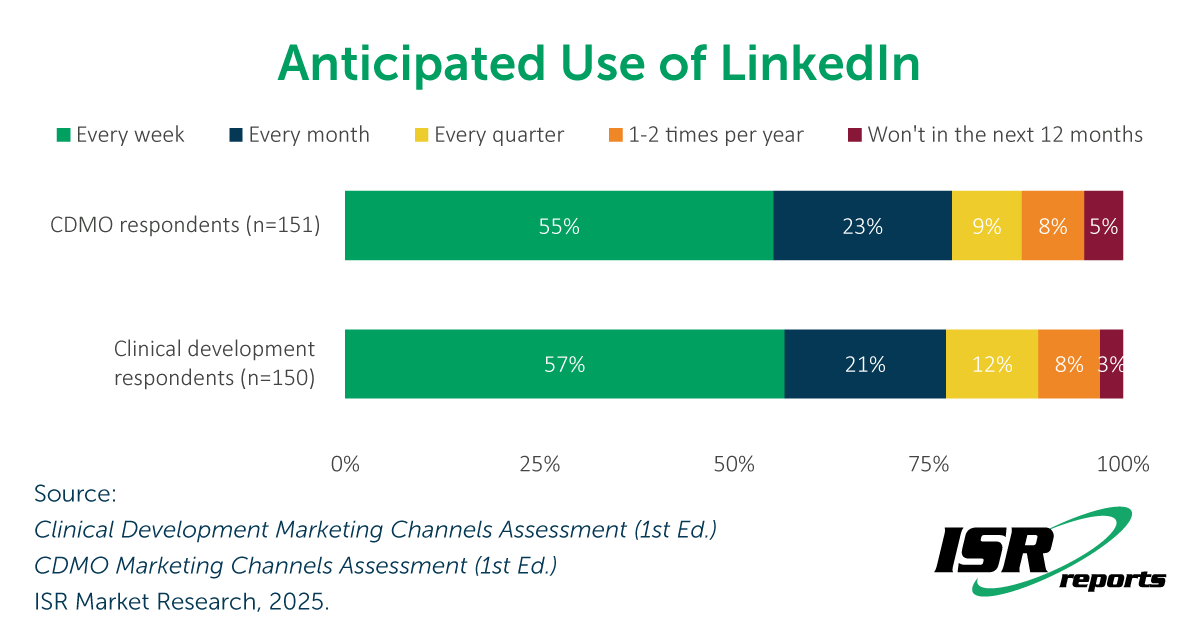

“If you build it, they will come” is not only a misquoted line from a movie you may have never seen, but this ubiquitous business phrase also misses the mark of what customers actually want. No one gets excited to visit your multiple websites to figure out what you do and what they can learn from you; you need to bring relevant information and meet them where they are first.

Our Marketing Channels readers will learn what sources pharma respondents are most likely to use, but we won’t keep the big one a secret: 55% of CDMO-focused respondents and 57% of clinical development-focused respondents plan to use LinkedIn every week.

Follow Us for the Latest Marketing Channels Research

These data come from our Clinical Development Marketing Channels (1st Ed.) and CDMO Marketing Channels (1st Ed.) reports. Register an account on our website and follow us on LinkedIn to stay up to date on new versions of these reports and other primary market research available in our syndicated library.