In our recent report on clinical trial management systems, CTMS Benchmarking & Market Dynamics (3rd edition), Industry Standard Research explores the evolution of the eClinical market and usage of CTMS in the outsourcing community. Amidst this rapid growth, it can be difficult to keep up with the requirements that sponsor organizations, CROs, and clinical trial sites have for their CTMS solutions.

ISR has been conducting follow-up interviews with survey participants from our CTMS benchmarking report to learn more about the nuances of the CTMS outsourcing landscape. Not unlike the dynamics of the broader clinical services ecosystem, we found that although some sponsor organizations would prefer to use only one CTMS provider, most research participants reported utilizing multiple providers. There are various reasons for this: CROs may require sponsors to use their own CTMS or a specific CTMS provider when working together on clinical trials; there isn’t one tech provider that can satisfy all of their requirements; or certain CTMS solutions don’t integrate well with in-house systems or other eClinical technologies.

“When you’re running a big global study... we try to put as much of this onto the CRO, who we view as responsible for executing the trial, ... [including selecting] the various vendors which support the trial through them. Because then we can hold them clearly accountable and responsible for when something doesn’t work. And as a small biopharma company, if [the CRO] is not happy with [CTMS provider], they have a lot more clout with those folks than we do.”

Small Pharma Interviewee on Using Multiple CTMS Providers

“[We use one CTMS provider] just for consistency. We do use a number of CROs, so it’s easier to bring their data into one system rather than trying to have their CTMS systems speak with a number of different ones that we are using.”

Top 10 Pharma Interviewee on Using a Single CTMS Provider

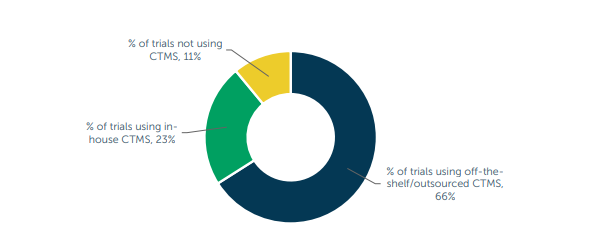

In the quantitative survey, we found that around two-thirds (66%) of clinical trials are currently managed with off-the-shelf/outsourced CTMS solutions, and a little under one-quarter (23%) are managed with in-house CTMS. Respondents expect these proportions to remain steady over the next two years. These findings align with the qualitative interviews, where participants described that the capabilities of in-house systems are often limited and need to be supplemented with third-party CTMS solutions.

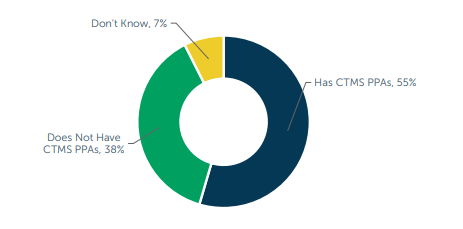

On average, 71% of respondents reported currently using three or fewer CTMS providers, and 29% used four or more providers. Only around one-quarter of respondents were currently using a single provider. Official preferred provider agreements also play a role in the selection of CTMS providers. Over one-half of respondents in the 2021 quantitative research indicate using PPAs to contract CTMS providers with an average of just under three preferred providers. However, these agreements are not without problems, as described by the interviewee below.

“So, the preference always is that we would like to go with one vendor, not multiple. But what happened is that we had to go [with a specific CTMS provider because of its capabilities], …but we weren’t satisfied with their other technologies. And then the sites ran into some difficulties… but [we’re] continuing to use [that CTMS provider] because it’s a preferred vendor of the company and the studies were ongoing at that time. It is difficult to discontinue or go to a new vendor and set up the process all over again.”

Top 25 Pharma

While reflecting on their current CTMS provider(s) and provisioning models, participants from sponsor organizations in both the quantitative survey and the qualitative interviews expressed myriad pain points in managing multiple providers as well as some of their unmet needs in working with single providers.

“I wish the systems would be able to talk [to each other] better. I don’t have the behindthe-scenes [information] on how to make everything connect, but it just seems that we’re collecting the same information. Why is it so difficult that two [different] systems can’t talk to each other and have that seamless flow of data coming through, like for instance, number of sites activated, or number of sites closed? There always seems to be a lag or somebody always has to go in and manually correct it.”

Top 10 Pharma

“The ease of the start-up is always much better with a single provider versus managing multiple [eClinical technology] providers and then integrating the data into one platform for the submission purposes. …One headache we face all the time is the reconciliation integration. We have a couple of labs in Japan and in Egypt, and their reporting is not different. But the uploading of the data into the system is very challenging. And then we had to find some mitigation measures to get that information in a single platform.”

Top 25 Pharma

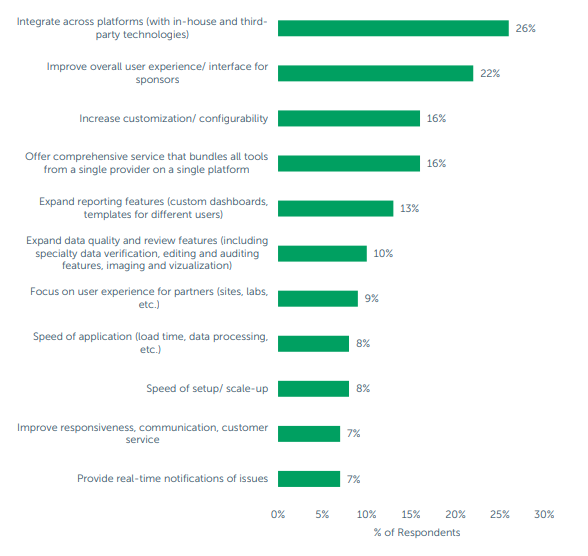

When asked what improvements they would request for the next generation of CTMS software solutions, survey respondents provided a wide range of detailed suggestions for CTMS providers. Over one-quarter of respondents felt that CTMS solutions needed to be better integrated with in-house systems and other eClinical technologies like EDC (electronic data capture) and IRT (interactive response technology). As suggested by the interviewee below, improving user experience (including at the site level) and configurability of the solution are also very important for sponsor organizations.

“[That provider] is just not mature enough yet, but… has a lot more user-friendliness, including friendliness on the part of the person at the site. …The easier you can make things at the site level, the more likely your study’s going to get the attention above someone else’s. Because when it’s all said and done, the site personnel are the ones who control the site enrollment, how much emphasis they put behind getting patients to return for subsequent visits, all that other kind of stuff. And the easier you can make their lives, the more they’re going to appreciate you as a company over somebody else.”

Small Pharma

These high-level suggestions for improvement are well aligned with the provider-level feedback that respondents shared both in the quantitative survey and qualitative interviews. At present, although some sponsor organizations may prefer to work with a single CTMS provider or fewer CTMS providers in the long term, it seems that individual CTMS solutions may not currently be able to satisfy all of their clinical trial management needs. Not all of the CTMS solutions offer the same features or have the same strengths, which represents an area of opportunity for CTMS providers to differentiate themselves. By focusing on the capabilities that are the most important to customers, CTMS providers may be able to close the gap on unmet needs and emerge with solutions that fit for most – if not all – clinical trials rather than only some.