The Evolution of Outsourcing

Over the past few decades there have been considerable changes in the outsourcing environment; at the outset, pharmaceutical companies were primarily offshoring to lower-cost centers and used different contract manufacturers for different projects in a somewhat haphazard manner. As the CDMO industry blossomed, an environment now exists where virtual biopharmaceutical companies can thrive and a prior $100M barrier to entry as a drug innovator has been removed.

The past 25 years have seen a steady progression in business relationships between CDMOs and drug developers. The initial focus on identifying supply chain inefficiencies to improve operations and reduce costs grew into simple client-vendor relationships, which remained largely transactional in nature. There was not a lot of trust between the parties and there was a tendency for pharmaceutical companies to give commoditized work to contractors and to keep activities in-house that might put IP at risk.

Over the years, trust between drug developers and CDMOs began to grow; some of these interactions expanded to become preferred provider relationships, where a stronger connection between client and vendor provided more opportunity for cost savings. As outsourcing continues to mature, drug developers’ motivations have shifted from controlling fixed costs and capacity fluctuations to gaining access to specific technologies, skills, and/or scientific expertise not possessed in-house. These newer ventures, often referred to as strategic partnerships between a drug developer and a CDMO, allow the advantages of a long-term relationship to truly manifest. Regardless of how the partnership is defined, drug innovators are relying more and more on CDMOs to help solve the biopharmaceutical industry’s toughest challenges.

As the pharmaceutical contract manufacturing industry matures, the benefits for drug developers of being able to outsource manufacturing have expanded far beyond cost savings. Established pharma companies can strategically engage external manufacturers in order to focus on discovery and marketing, and new and emerging biopharmaceutical companies with no internal manufacturing capacity are able to utilize CDMOs to further their discoveries. Building the right kind of drug developer-CDMO relationship can accelerate a company toward achieving its drug development and commercialization goals.

Market research conducted by Industry Standard Research (ISR) shows that drug developers building outsourcing relationships should ask themselves several important questions, starting with their outsourcing drivers, such as, “What is our available capacity?” and “Do we possess the necessary internal expertise?” The answers to these questions will inform which characteristics a drug developer should prioritize when evaluating contract manufacturers.

Identify Outsourcing Drivers

It might be cost- or time-savings or access to technologies, skills, scientific expertise, or capacity; there are many reasons for a drug developer to hire a CDMO. There is usually more than one motivation for engaging a CDMO, and most companies use a combination of outsourcing approaches to accomplish all of their manufacturing needs.

The top-level consideration for a drug developer is whether their company has some internal manufacturing capabilities, which means they would use CDMOs to supplement their own manufacturing; if the drug developer has no internal capacity, they would need to use CDMOs for all manufacturing activities.

Among drug developers with internal manufacturing capabilities, it is important to consider how internal experience and capacity will influence the use of CDMOs. For this type of outsourcer, there are four main reasons that manufacturing may be split between in-house and external resources. The reasons can be summarized as: 1) adequate experience and adequate capacity; outsource for strategic reasons, 2) adequate experience but inadequate capacity, 3) inadequate experience but adequate capacity, and 4) inadequate experience and inadequate capacity.

The reason to look at outsourcing from these vantage points is that market research shows there are behavioral differences among drug developers that stem from these drivers. The different motivations should play a central role in determining the best outsourcing approach for one’s organization. For example, if a drug developer has internal manufacturing capabilities but not enough available capacity, the business needs a secondary supplier to augment the supply manufactured in-house. This type of outsourcer — one seeking a secondary supplier — has different needs from a drug developer that outsources all manufacturing.

It also means companies hiring secondary suppliers have different CDMO selection criteria from companies hiring primary suppliers. When a drug developer needs access to capacity as opposed to scientific know-how, timelines, a solid regulatory history, and reliable, on-time delivery are top decision factors.

On the other hand, a drug developer that engages a CDMO as a primary supplier has a whole suite of different needs. This type of outsourcer, such as a virtual biopharma that has no manufacturing facilities, needs to engage CDMOs for all manufacturing-related services, and must also rely on CDMOs for scientific expertise, because they don’t have experience manufacturing the compound/product themselves. So, while access to capacity factors into outsourcing approach and CDMO selection criteria, it is not the primary factor or even a top five consideration for this type of drug developer.

ISR research shows that among this type of outsourcer, the most important CDMO selection criteria are scientific knowledge, experience level of staff, and right-first-time measurements. Virtual biopharmaceutical companies’ outsourcing approach should be directed by the absence of in-house manufacturing expertise, which points toward a more long-term, strategic engagement of CDMOs.

Accordingly, before a drug developer starts to think about CDMO selection criteria or which specific CDMOs to consider for a project, it is important for a company to deeply understand why it is outsourcing manufacturing in the first place. Those motivations should guide a company’s outsourcing approach and inform the CDMO selection criteria, which together influence which CDMOs a company should shortlist.

Choose the Right Outsourcing Model(s)

There are three main categories for the many ways outsourcing relationships are contracted: tactical or transactional relationships, preferred provider agreements, and strategic relationships. Tactical outsourcing is when a drug developer outsources manufacturing projects on a one-off basis and assesses suppliers based on each specific project’s needs (traditional CMO outsourcing). Preferred providers are a drug developer’s select group of prequalified CDMOs, and these providers are awarded the majority of the company’s outsourced manufacturing work. Strategic partnerships are when a drug developer establishes a relationship with a specific CDMO that allows both parties to predict the flow of work, leverage knowledge and expertise around the drug developer’s pipeline, and optimize efficiencies offered by predictable, repeat business.

Outsourcing relationships that fall under the “tactical” category tend to be transactional and focused on a service or activity being executed by an external provider. In fact, they are hardly relationships at all. Tactical engagements require less planning, which sometimes corresponds to a higher level of dissatisfaction. Tactical relationships may be contracted as fee for service, time and materials, and toll manufacturing, among other options.

Preferred provider relationships stem from the desire for a specific CDMO that the drug developer has used in the past to provide the same or a new service for the drug developer. Many of these relationships were initially based on regular access to capacity, yet their development reflects basic human nature in being drawn to the familiar. This familiarity can reduce risk and foster stability because an outsourcer has a good idea of what to expect. Another important benefit of repeat business is that it can reduce decision-making time and avoid decision-making fatigue. In the world of outsourced pharmaceutical manufacturing, reducing the time it takes to select and qualify a supplier may save weeks or even months. Preferred provider contracts may be in the form of a clinical supply agreement or a commercial supply agreement, or any agreement to provide X amounts of cGMP material or drug product at specific time intervals.

Strategic partnerships, the third category of outsourcing relationships, take the most planning and forethought for mutual success to ensue. Strategic partnerships form with a goal of developing a long-term relationship where specific skills, scientific knowledge, and expertise may be leveraged. These partnerships enable deep engagement between outsourcing partners, which also reduces risk, specifically for virtual biopharma companies. For example, a virtual company may choose to work with a large CDMO that has a good understanding of the regulatory environment. This can help the drug developer avoid mistakes and save valuable time over the course of development. Ways in which CDMOs and drug developers may contract these agreements include full-time equivalent (FTE)/extended workbench, in-sourcing (staff), risk/reward or risk sharing, and milestone. A strategic partnership may also include terms that speak to a dedicated, consistent team at the specific CDMO.

Establish a Decision-Making Process and CDMO Selection Criteria

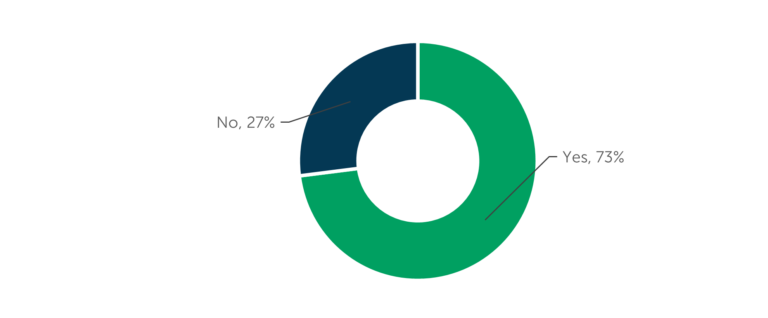

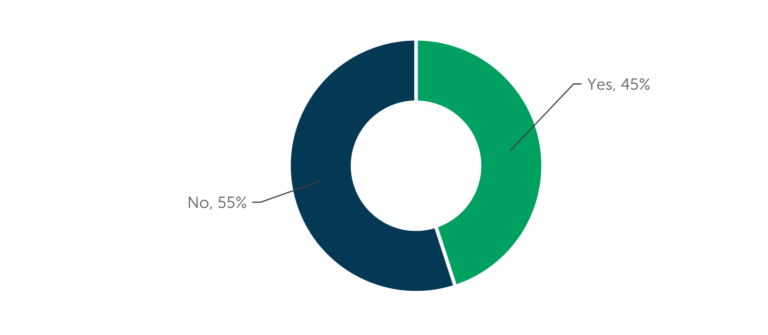

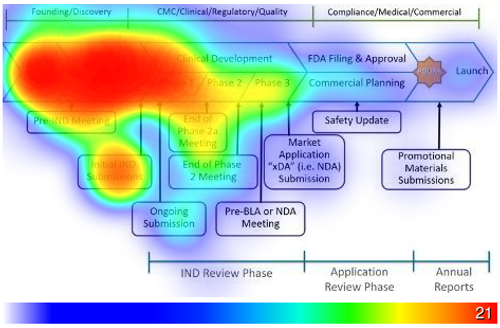

It is common for biopharmaceutical companies to formally budget for the CDMO selection process. Three-quarters (73 percent) of manufacturing outsourcers confirm formal budgets and 45 percent of outsourcers mention the company they work for uses consultants to help guide their CDMO choice, according to data from ISR’s research on manufacturing outsourcing models [See Figure 1 and Figure 2]. New and emerging biopharmaceutical companies are more likely to use consultants to guide outsourcing provider selection, while large pharma companies are more likely to have procurement departments involved in the process. When engaging a CDMO for development work, drug developers start the process as early as during the initial studies and most often have a CDMO engaged by the end of Phase 1 [Figure 3]. The timeline for engaging a CDMO for commercial manufacturing may begin as early as preclinical development, but most often takes place between Phase 1 and Phase 3 of clinical development. It is not unusual to engage additional contract manufacturers after commercial launch to meet demand or to access additional markets.

The various approaches to the CDMO decision-making process fall into three main categories: group consensus, group scoring analysis, and executive decision. Company size and available resources often influence which decision-making approach a biopharmaceutical company uses. Market research shows group consensus is among the most popular at both small and large biopharma companies, while a group scoring matrix analysis is more common at larger companies with more resources (such as a procurement department) and fewer C-level stakeholders with hands-on involvement. The CEO, CSO, or head of manufacturing may choose the contract manufacturer at a small, emerging biopharma company, but this is rarely the case at an established biopharmaceutical company where risk must be balanced across a variety of metrics.

Figure 1 – CDMO Selection Budget

“Does the company you work for formally budget for CDMO/CMO selection?” (n=108)

Figure 2 – Use of Consultants

“Does the company you work for use industry consultants to help guide CDMO/CMO selection?” (n=108)

Figure 3 – Drug Development CDMO Engagement Timelines

“To the best of your knowledge, at what point does the company you work for start to look for a CDMO for drug development manufacturing? Click the graphic of the timeline to indicate when your CDMO search begins. Click the graphic a second time to indicate when your CDMO decision has been made.” (n=108)

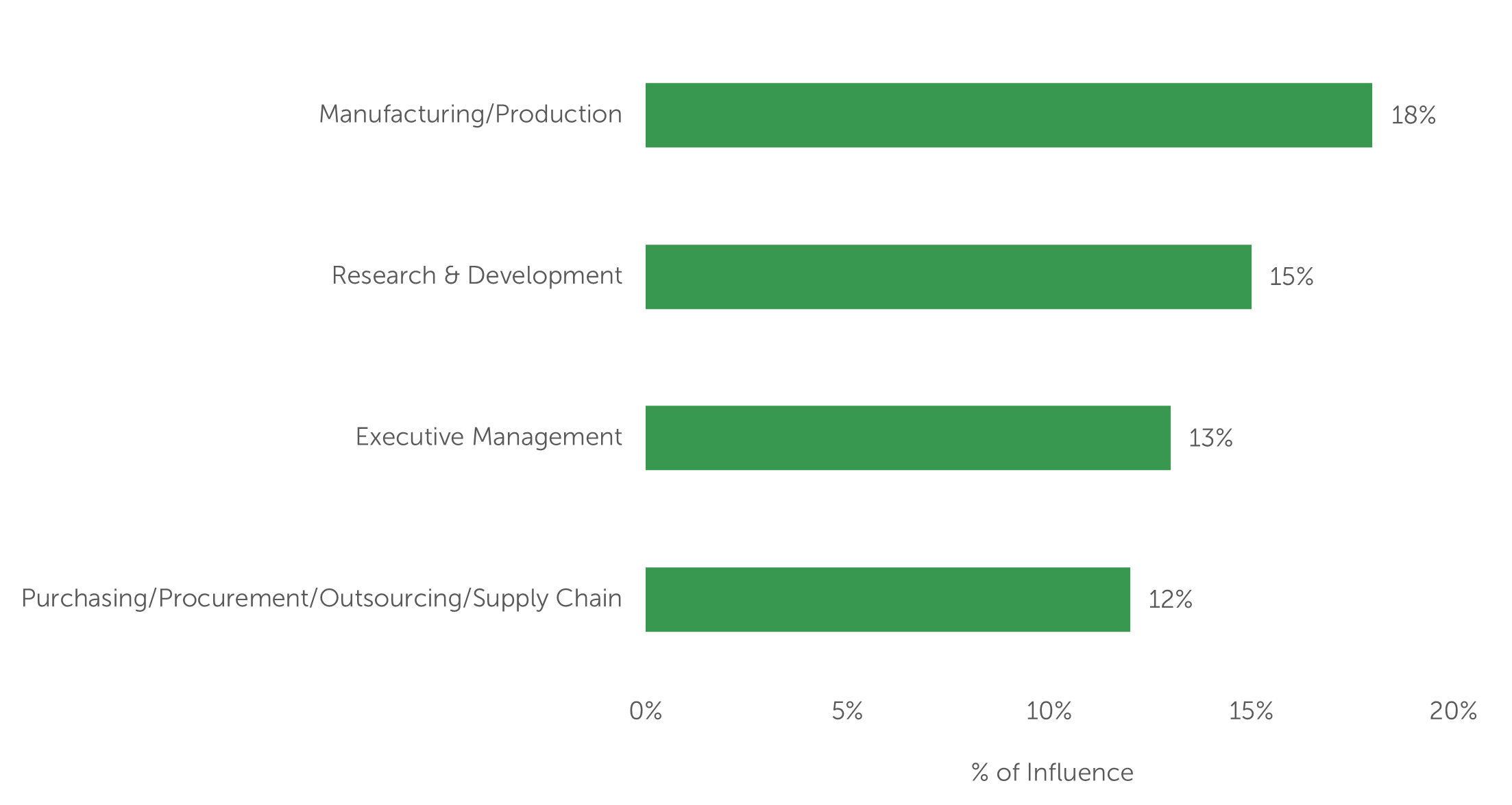

Drug developers that use a group approach for CDMO selection may have as few as four high-level individuals (at a virtual biopharma company) or as many as a dozen departments (at a Big Pharma company) represented. Industry Standard Research data shows that for outsourced bioprocessing work, manufacturing/production, research & development, and executive management together possess almost half of the influence over the CDMO selection decision. Other members of the CDMO decision-making group include purchasing/procurement, clinical development, quality assurance, scientists, drug discovery/preclinical, project management, regulatory affairs, and validation (listed in descending order of influence) [Figure 4]. As virtual biopharma companies grow, the addition of a purchasing/procurement, or “outsourcing,” department is prioritized as the function can help to relieve executive management of some of the time-consuming aspects of the CMO selection and vetting process. Additionally, the purchasing/procurement department often helps to formalize outsourcing processes and the selection metrics used to assess potential contract manufacturing partners.

Figure 4 – Department Influence on CMO Selection

“Please allocate the amount of influence each department has on the selection of a new contract manufacturer for a biomanufacturing project. Please ensure your allocation totals 100%.” (n=100)

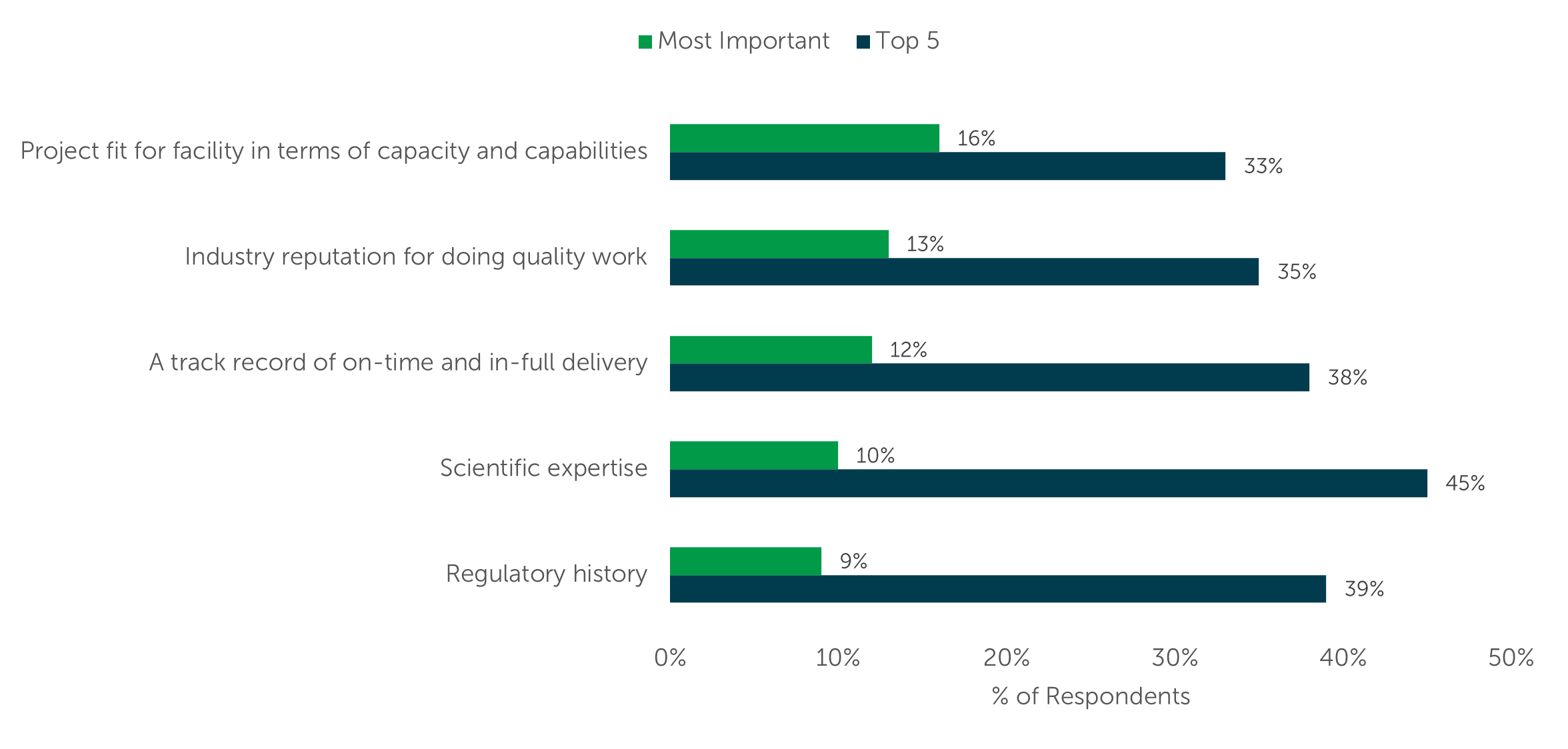

When choosing a contract manufacturer for bioprocessing, data from ISR’s Bioprocessing Market Trends and Outsourcing Dynamics reports show the top five CDMO selection metrics remain consistent despite some changes in their ranking over the past three iterations of the research. The selection metrics, in ranked order are Project fit for facility in terms of capacity and capabilities (#1), a CDMO’s Industry reputation for doing quality work (#2), A track record of on-time and in-full delivery (#3), Scientific expertise (#4), and Regulatory history (#5) [Figure 5]. The knowledge that experienced outsourcers have picked the same five attributes (out of 25 options) as the most important to bioprocessing CDMO selection over the past five years should give new outsourcers confidence that focusing on these attributes is a good place to start the CDMO selection process, too.

Figure 5 – CMO Selection Attributes

“Which service provider attributes do you value the most when selecting a CMO for an outsourced bioprocessing project? Select all that apply.” (n=100)

“From these attributes, which one do you value the most when selecting a CMO for an outsourced bioprocessing project?” (n=100)

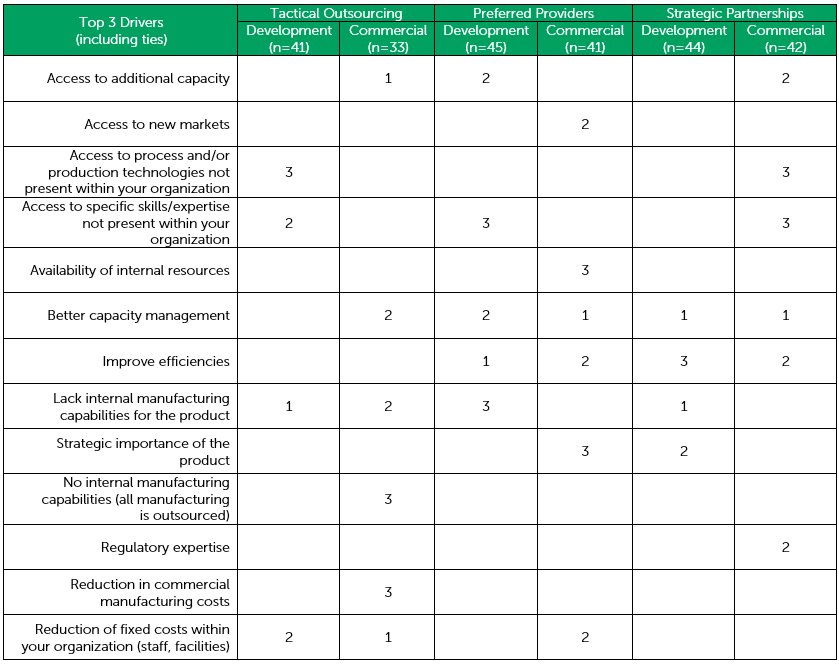

Recognizing and prioritizing internal outsourcing drivers helps drug developers prioritize their needs from a CDMO. Top-level issues — access to capacity vs. access to specific skills/expertise not present in-house — can direct a drug developer toward the right outsourcing model and should inform CDMO selection criteria [Table 1]. Up-front communication of needs, internal resources, and service provider selection criteria with prospective CDMOs enables contract manufacturers to build complementary teams to balance individual drug developers’ specific requirements. Using these steps, drug developers can build strategic outsourcing relationships where their internal expertise is complemented by external CDMO resources.

In the outsourced pharmaceutical industry, certain situations deserve up-front time for investment and planning. While it may appear more actionable to jump right to the execution stage, incomplete or absent strategies often lead to lower productivity. And it can be more difficult to develop or change plans in the later stages of the molecule’s development when activities are already in motion. Planning and relationship building are often viewed as non-urgent activities despite their importance. The lack of urgency can lead to these processes being undervalued and potentially omitted from a drug developer’s strategy to market. Biopharmaceutical companies that put time and effort into establishing an outsourcing plan — by identifying outsourcing drivers, selecting a contracting model that matches the company’s needs and resources, and establishing a decision-making process and CDMO selection criteria — set themselves up for continued success. A complementary CDMO can help a drug developer know when it makes sense to spend additional up-front time (and money) on process development to avoid manufacturing complications at scale-up. Technology transfers benefit from up-front planning and an adequate investment of time and resources as well as a deep understanding between the drug developer and CDMO. By taking the time to uncover and understand internal gaps in knowledge and/or resources, a business can find service provider(s) that help balance their limitations. A codified outsourcing strategy also means similar decisions can be made more quickly in the future. For these reasons and others, strategic engagement of outsourcing partners can ultimately help drug developers save time in clinical development and bring medicines to market faster.

Table 1 – Selection Driver Overview

Sources

Figure 1, 2, and 3: 2021 CDMO Outsourcing Models

Figure 4 and 5: 2020 Bioprocessing Market Dynamics

Table 1: 2021 CDMO Outsourcing Models