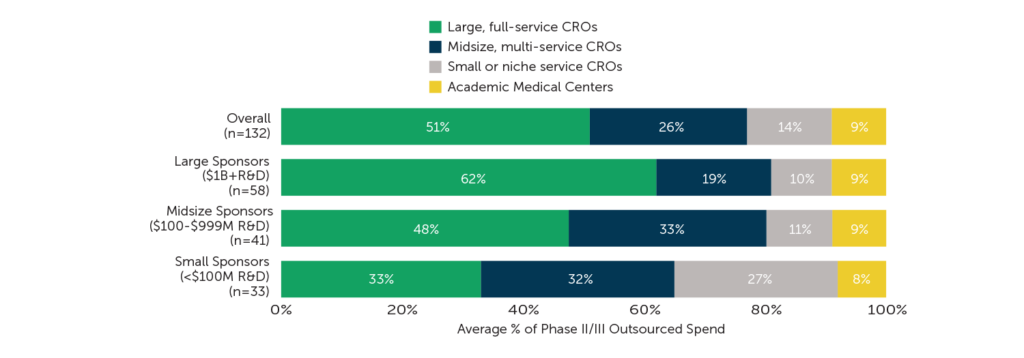

Industry Standard Research conducted a 2022 survey with outsourcers of Phase II/III clinical development activities to better understand the dynamics in this space. Learning how respondents from sponsor organizations apportion their outsourced work across different provider types was of particular interest.

Overall, half of Phase II/III outsourcing spend goes to large, full-service CROs (51%) while one-quarter of spend (26%) goes to midsize, multi-service CROs. Small or niche service CROs and academic medical centers (AMCs) receive the remaining 14% and 9% of spend, respectively.

Some interesting differences in outsourced Phase II/III spend emerge when the data are analyzed by size of the sponsor organization. The proportion of spend allocated to large, full-service CROs increases as sponsor size increases. Respondents from large sponsors report allocating three out of five Phase II/III outsourced dollars to big providers while those at small sponsors allocate only one-third of their outsourced spend to large CROs. Respondents indicate that use of midsize, multi-service providers is slightly higher among midsize (33%) and small sponsor organizations (32%) than it is among large sponsors (19%). Small sponsors allocate more Phase II/III spend to small CROs than midsize or large sponsors (27% vs. 10%-11%), but sponsors of all sizes equally engage AMCs for their outsourcing needs. Respondents expect the proportion of outsourcing spend allocated to each provider type to remain relatively steady over the coming years.

Prior ISR research indicates that large CROs are leveraged for their Global footprint, Breadth of service, and Capacity/resource availability. Midsize providers stand out for Quality, Project management, and Flexibility. Small or niche service CROs are considered to have the benefit of Flexibility as well as Specialized focus, Local knowledge, and Low cost. AMCs are also noted for having the benefit of a Specialized focus while KOL access, Strong investigator relationships, and Specialized facilities/equipment arise as differentiators for AMCs.

Fig. 1 – “Please estimate the percent of your company’s Phase II/III outsourcing spend with each of the following types of service providers. Your best estimate is fine. Columns must total 100%.”

Considerations for CRO Selection

A sponsor’s needs and preferences can certainly vary from trial to trial. A global CRO that can handle a full-service Phase II/III project may be perfect for one trial while a smaller, more specialized CRO might be a better choice for a different trial. Understanding the industry’s perceptions of the benefits of each provider type can be useful to a sponsor team when selecting their next CRO and can be similarly helpful to CRO teams when bidding for services either within or outside of their perceived wheelhouse.