The world is flush with economic uncertainty, so this may come as a surprise: the CRO market has been experiencing steady growth. Even with a global pandemic, this growth trend is expected to continue. (See our just-published report 2023 CRO Market Size and Growth Projections for details.) The increasing number of clinical trials, rising outsourcing of research and development activities, and the demand for specialized services are some of the key drivers of the CRO market. Furthermore, the continued growth of biologics has caused an increased utilization of CROs. A prevalence of chronic disorders, along with an increased demand for advanced or alternative treatments has also contributed to this CRO market growth.

Pharmaceutical companies have seen an increase in revenue and that has translated to higher investment in R&D, leading to continued CRO market growth. Industry Standard Research (ISR) predicts the 2023 expenditures for different service categories, along with the distribution percentages for each service line.

The table below has the alphabetized service lines and percentages are included in the report.

Fig. 1 – Promotional Table to showcase what is in the report: 2023 Service-Line Distribution (%) of the CRO Market Size.

Outsourcing to CROs

Clinical trials are a vital part of the drug development process, allowing pharmaceutical companies to evaluate the safety and efficacy of new therapies before they are approved for use by patients. But conducting clinical trials is a complex and time-consuming process, involving a range of activities from patient recruitment to data analysis. For many companies, outsourcing these activities to contract research organizations (CROs) has become a popular option to increase efficiency and reduce costs.

Outsourcing activities in clinical trials can offer a range of benefits to pharmaceutical companies. CROs often have specialized expertise and infrastructure that can streamline the trial process, reducing the time and costs associated with conducting trials in-house. They can also help companies navigate complex regulatory requirements. Utilizing a CRO to accelerate drug development timelines has been cited as a motivator among respondents, year after year, across multiple Industry Standard Research surveys.

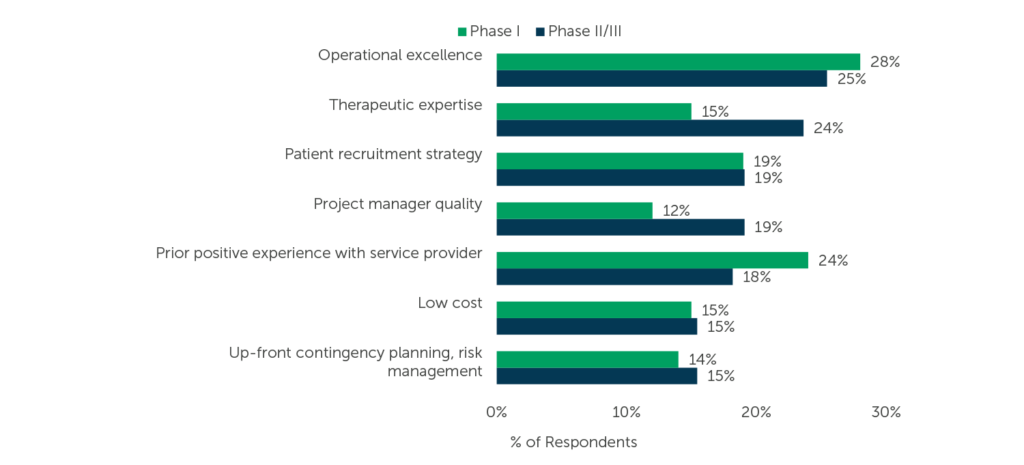

ISR aims to equip biopharma professionals with reliable, trustworthy data, and that’s why we ask respondents about CRO selection attributes. Looking at the attributes selected as most important when selecting a service provider, Operational excellence is the most-selected attribute by respondents who recently outsourced Phase I services and among those who recently outsourced Phase II/III services (two different benchmarks. See Phase I here and Phase II/III here).

Fig. 2 (n=105 for Phase I, n=110 for Phase II/III, only asked of respondents whose companies do not have preferred providers) “Which of the following attributes has/have become more important as selection criteria for [Phase I / Phase II/III] studies over the past 12 months? Select up to 3.”

Satisfaction with Services

Ultimately, a CRO wants business. Part of winning those bids is being preferred, whether it’s a formal preference through Preferred Provider Agreements (PPAs) – which we see more often at large sponsor companies than non-large (see our recent benchmark reports) – or through individual preference, as a matter of perspective and experience.

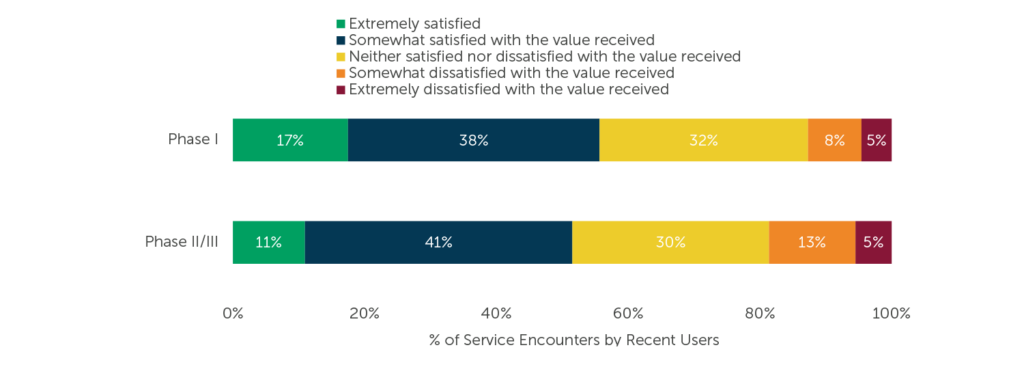

Sponsors that are satisfied with the services received are more likely to repeat business. Are the satisfaction ratings among recent users due to providers’ resources – that Operational excellence we discussed? Is this an attribute found only among particular CROs? (No, we think any CRO can provide excellence, it’s just a matter of knowing what the sponsor needs). We asked respondents about their recent service encounters with CROs for Phase I and Phase II/III services. View their satisfaction ratings for the value received below.

Fig. 3 (Sample size varies by number of users, per CRO) “Please indicate how satisfied you are with the value of the services you received from each of the below providers. Please think of ‘value’ as the services you received as compared to the cost for those services.”

Roughly half of service encounters by recent users were at least somewhat satisfactory for the value received. On the other hand, less than 20% of Phase I and for Phase II/III service encounters, each, were somewhat or extremely dissatisfying.

Overall, outsourcing to CROs can help pharmaceutical companies reduce costs, accelerate timelines, and access specialized expertise and resources, thereby increasing the chances of success for drug development. To learn more about selection attributes, CRO ratings, recent users satisfaction, and more, read our Phase I CRO Benchmarking, Phase II/III CRO Benchmarking, and the 2023 CRO Market Size and Growth Projections reports.

Market research data in this article was powered by the ISR Health Panel. Want to contribute to thought leadership pieces and help to make the pharma industry better? Join the Health Panel today.